Banks typically feature in the average investor's portfolio as they are usually major components in the stock market index and are well-known brand names. Banks also make good dividend stocks in general, owing to their relative stability in dividend payments.

However, they are often the least understood of stocks in an investor's portfolio, from a fundamentals perspective, due to the complexities surrounding the sector. In this series of articles, I will attempt to simplify the standard framework utilised by institutions and regulators in analysing the banking sector. These are some of the factors that makes analysing banks a relatively challenging endeavor:

- Macroeconomic plays. Large banks are generally less susceptible to microeconomic or industry trends, such as fluctuations in commodity prices or boom and bust cycles of industries. They are, however, tied to the business cycle, fiscal and monetary policy on both domestic and global levels.

- Specialised financial statements. Interpreting a bank’s financial statement can be a daunting task for the uninitiated, even if the investor is familiar with interpreting financial statements of ordinary listed companies. The financial ratios for banks are highly specialized and specific to the sector, with increasing complexity over the years due to greater scrutiny by regulators.

- Heavily regulated sector. In the aftermath of the Global Financial Crisis, the global banking sector have been subject to heightened scrutiny and regulations by their governments. Banks are required to comply with a myriad of regulations and ratios, with increasingly complex regulatory requirements being enforced over the years.

A standard model used by regulators for monitoring banks is the CAMELS system. Though I am not advocating that the individual investor monitor banks in the same way that a central bank would, the framework provides a neat and orderly manner to evaluate the financial strength of a bank. Also, the CAMELS framework provides a set of financial ratios that makes banks comparable, even on an international basis. For practical purposes, I will only discuss the CAMEL of the model, omitting S or the Sensitivity component, since such data is often inaccessible, and also unnecessary for the individual investor to analyse.

C - Capital adequacy

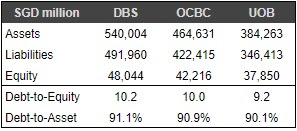

A bank’s business model of taking deposits (borrowing) and giving out loans (lending) implies that banks inherently employ leverage. For every dollar of shareholders equity, an average bank borrows about$10 and lends it out, leading to a debt-to-equity ratio of 10x. In contrast, typical corporations are considered to be highly leveraged if their debt-to-equity ratio exceeds 1x or debt-to-asset ratio of 50%. For comparison sake, S-REITs have a statutory debt-to-asset ratio limit of 45% (debt-to-equity equivalent: 0.81x).

The tables below demonstrates simplified balance sheets and leverage levels of the largest Singaporean and Chinese banks as of 30th June 2018. The ratios below are strictly for the sake of illustrating how highly leveraged banks are, though in practice the financial industry employs highly specialised ratios to measure leverage and capital ratios.

Capital ratios have gained prominence in the aftermath of the Global Financial Crisis of 2008-2009 and meltdown of banks across the US and Europe (Iceland, UK). The subsequent European Debt Crisis of 2010-2012 which was triggered by Greece teetering on the edge of bankruptcy, further exposed the frailty of the global banking system. The reason is this- let us assume that a bank takes $9 of deposits for every $1 of shareholder equity and lends that entire $10. If the bank were to suffer a default rate of 10% or more, the bank is effectively insolvent as all shareholder equity is wiped out, and depositor funds are now at risk. This causes the bank to become vulnerable to a bank run, which could spread to healthy banks if the public confidence in the banking system erodes.

This was the crux of the subprime mortgage crisis that precipitated the Global Financial Crisis, as the US banking system was loaded up with dubious or outright bad loans. At the height of the crisis, no one knew the true extent of bad loans (referred to as ‘toxic assets’) that each bank held, or which bank was effectively insolvent, thereby leading to a freeze in the entire financial system. It was only through massive intervention (read ‘bailout’) by the Federal Reserve and US government did the banking system unfreeze and the crisis end. Hence, from a regulator's perspective, a bank's shareholder equity functions as cushion that is able to absorb losses.

In general, the higher the leverage employed, the more vulnerable a bank is to failure if its assets go bad. The conventional ratios used to measure leverage for corporates are inadequate for financial institutions given the complexities of their balance sheet. This is because the ‘riskiness’ of a bank is not just measured by the degree of leverage employed, but also the quality of the assets that the borrowed money is deployed to. A bank that borrows $99 for every $1 of equity, but invests the entire $100 into risk-free government bonds is safer than a bank that borrows $9 for every $1 of equity and lends it out as subprime mortgages.

The international framework that was established under the Basel Accords has precise ratios to measure these risks. The ratios that deal specifically with a bank’s leverage and capital levels are referred to as Capital Adequacy Ratios. The broadest Capital Adequacy Ratio (CAR) consists of:

Tier One Capital refers to the 'highest' level of capital, which consist of common shareholder equity, reserves and a new class of perpetual bonds. This new class of perpetual bonds were introduced by the Basel III framework following the Global Financial Crisis, and their designated nomenclature by the industry is ‘contingent convertibles’. Under the current Capital Adequacy framework, these contingent convertibles are recognized as 'Additional Tier One Capital'.

Tier Two Capital refers to subordinated debt issued to institutional investors and are accepted as capital under Basel regulations. These securities are also classified as 'contingent convertibles' alongside the perpetual bonds described above.

Contingent convertibles were created to provide banks with an additional layer of buffer between common shareholders and senior-ranked bank creditors (depositors, senior bondholders). It should be noted that contingent convertibles are regarded as a distinct asset class of their own. This is because they have a 'loss-absorption' clause that allows the central bank and/or other regulators to convert these bonds into equity (without requiring the consent of bondholders, or to go through the legal system typical in the liquidation of a firm) in the event of a crisis that wipes out the bank's common equity. As they are highly-specialized bonds, I will devote a specific article to this asset class in a separate article. An example of this class of perpetual bond that was issued in November 2018 by UBS.

Tier Two Capital refers to subordinated debt issued to institutional investors and are accepted as capital under Basel regulations. These securities are also classified as 'contingent convertibles' alongside the perpetual bonds described above.

Contingent convertibles were created to provide banks with an additional layer of buffer between common shareholders and senior-ranked bank creditors (depositors, senior bondholders). It should be noted that contingent convertibles are regarded as a distinct asset class of their own. This is because they have a 'loss-absorption' clause that allows the central bank and/or other regulators to convert these bonds into equity (without requiring the consent of bondholders, or to go through the legal system typical in the liquidation of a firm) in the event of a crisis that wipes out the bank's common equity. As they are highly-specialized bonds, I will devote a specific article to this asset class in a separate article. An example of this class of perpetual bond that was issued in November 2018 by UBS.

Risk Weighted Assets refer to the assets on a bank’s balance sheet. The calculations are technical in nature but it is sufficient to say that the riskier the investment, the higher the Risk Weighted Asset is. In simple terms, the equation above describes the amount of capital that a bank needs to hold for an asset, adjusted for the risk of the asset. Government bonds are deemed to be risk-free and are ‘zero-risk weighted’, that is have a zero value when calculating the CAR. This implies that a bank who takes deposits and invests into government bonds will not be required to hold any capital for that portion of assets. On the other hand, a high risk loan will require a bank to hold a significant proportion of capital, thus limiting the amount of leverage a bank can take on risky loans.

The tables below are the formal measures of the banks’ leverage, or formally known as their capital adequacy ratios. The first line, Common Equity Tier 1 (CET1) Capital Ratio, measures the strictest ('highest') form of capital, that is common shareholder equity and retained earnings. The next line adds perpetual bonds issued by the bank and certain regulatory reserves to the CET1. Finally, the third line shows the broadest capital adequacy ratio that captures Tier 1 and Tier 2 capital.

The higher the ratios, the more capitalised the bank is, or the lower the leverage level of the bank. In the case of the Singaporean banks, UOB stands out for its higher capital ratios as compared to the other two banks. But how do these ratios stack up against regulatory requirements? Basel accords prescribe a minimum of 6% for CET1 levels but the Monetary Authority of Singapore (MAS) has set a higher requirement of 9% for banks under its purview.

To complicate matters, banks that are designated as domestic systemically important banks (D-SIBs) by MAS are required to hold higher levels than the chart above. Beyond mentioning the above, I will delve no further into regulatory requirements on this aspect. Fortunately for investors, banks’ financial statements typically disclose the minimum levels required by their respective regulator, that is, their central bank. The following extract is from DBS’ financial statements as of 2Q18.

By now, the reader may presume that a better capitalised (and lower leveraged) bank is superior to that of a lower capitalised bank. However, that solely depends on the stakeholder. In the eyes of the government and central bank, higher capital ratios are definitely preferable as it reduces the risk of a financial crisis in the banking system.

As an individual depositor, you would sleep better knowing that your bank if your bank is taking on less risk with your money. Also, if you are invested into bonds that are issued by a bank, you would prefer a stronger bank. However, as a shareholder of a bank stock, this would depend on your risk appetite.

A bank with lower capital ratios could indicate that the bank is taking on more risk (higher leverage), and as such could potentially generate more profits during an upswing in the business cycle. Banks with lower capital ratios enjoy a higher return on equity by virtue of the smaller equity denominator.

Basically, since shareholders enjoy the residual profit of a business (after paying off all the other stakeholders including debtors), the larger the equity base, profits have to be shared across a larger base. If a bank’s core capital ratios are deemed to be too low, the bank will be required to raise new capital in the form of rights or a secondary IPO of shares, which is dilutive to existing shareholders. I will explore this issue of profitability in an upcoming article in this series on the banking sector.

Summary

Banks are essentially heavily leveraged entities. Central banks regulate the amount of leverage that a bank can take, and measure them using the International Framework established by the Basel Accords. These ratios are known as the Capital Adequacy Ratios. Higher Capital Adequacy Ratios imply that a bank is better prepared to withstand a crisis. However, the flip-side of being very well capitalised is lower profitability for its shareholders. Investors need to keep this in mind when looking at bank stocks since profitability ratios tend to correlate negatively with capital ratios. Understanding the perspective of a regulator is important as it will allow the investor to be aware of the constraints that a bank experiences.

Thanks for writing such quality articles, it had given me a better understanding of the companies. Added to my reading list.

ReplyDeletehttps://sgstocklink.blogspot.com/

investing in oil and gas has and is still making a lot of people " very RICH". Investors in oil and gas are getting rich daily. All you need is a secured and certified strategy that will keep your invested capital safe by opting out with no withdrawer crunch. A considerable number of investors worldwide have seen gains of 75,063%, personally I have made over 600%. For example I started investing with $1,000 and I made $3,000, $3,500- $5,000 weekly. Last year at the start of the year, I increased my invested capital to $10,000 and I made approximately $105,000 before the end of year. I've never seen profit opportunities like this before in any market even when other traders complain of losses. Now for the doubters, not only is it possible, it's actually happening right now. All you need is a good and secured strategy, a good investment platform, Appetite and market conditions. Incase you are interested in venturing into investing or perhaps you are trading and has been losing, feel free to contact total company at E-mail: total.company@aol.com or Instagram IG: @total_company , I will

Deletebe sure to guide and assist you.

KABAR BAIK!!! KABAR BAIK!!! KABAR BAIK!!!

DeleteNama saya Liliyana. Saya ingin menggunakan media ini untuk mengingatkan semua pencari pinjaman agar sangat berhati-hati, karena ada penipuan di mana-mana, mereka akan mengirim dokumen perjanjian palsu kepada Anda dan mereka akan mengatakan tidak ada pembayaran dimuka, tetapi mereka iseng, karena mereka kemudian akan bertanya pembayaran biaya lisensi atau biaya registrasi dan biaya transfer, jadi berhati-hatilah dengan perusahaan pinjaman palsu mereka.

Beberapa minggu yang lalu saya tegang secara finansial dan berkecil hati, saya tertipu oleh beberapa pemberi pinjaman online. Saya hampir kehilangan harapan sampai Tuhan menggunakan teman saya yang merujuk saya ke pemberi pinjaman yang sangat andal bernama Mrs. Christabel Missan, yang meminjamkan pinjaman tanpa jaminan sebesar USD 100.000 dalam waktu kurang dari 24 jam tanpa tekanan atau tekanan dan tingkat bunga hanya 2%,

Saya sangat terkejut ketika saya memeriksa saldo rekening bank saya dan menemukan bahwa jumlah yang saya kirim dikirim langsung ke rekening bank saya tanpa penundaan.

Karena saya berjanji untuk membagikan kabar baik, sehingga orang bisa mendapatkan pinjaman dengan mudah tanpa stres. Jadi, jika Anda membutuhkan pinjaman dalam bentuk apa pun, silakan hubungi dia melalui email nyata: christabelloancompany@gmail.com dan dengan rahmat Tuhan ia tidak akan mengecewakan Anda dalam mendapatkan pinjaman jika Anda patuh.

Anda juga dapat menghubungi nomor whatsApp ibu +15614916019

Anda juga dapat menghubungi saya di email saya: liliyanabasuki@gmail.com dan Sety diperkenalkan dan berbicara tentang Ms. Christabel, dia juga mendapat pinjaman baru dari Ms. Christabel Missan, Anda juga dapat menghubunginya melalui email: permatabudiwati@gmail.com dan Anda juga dapat menghubungi Dian Pelangi yang memperkenalkan kami ke lianmeylad@gmail.com, yang akan saya lakukan adalah mencoba memenuhi pembayaran pinjaman saya yang saya kirim langsung ke akun mereka setiap bulannya

Sepatah kata cukup untuk orang bijak dari Indonesia dan Malaysia

Email: christabelloancompany@gmail.com

Facebook: christabelmissancompany@gmail.com

Anda juga dapat menghubungi nomor whatsApp ibu +15614916019

Panggilan telepon +15614916019

KABAR BAIK!!!

DeleteNama saya Lady Enny, saya ingin menggunakan media ini untuk mengingatkan semua pencari pinjaman agar sangat berhati-hati, karena ada penipuan di mana-mana, mereka akan mengirim dokumen perjanjian palsu kepada Anda dan mereka akan mengatakan tidak ada pembayaran di muka, tetapi mereka penipu, karena mereka kemudian akan meminta pembayaran biaya lisensi dan biaya transfer, jadi waspadalah terhadap Perusahaan Pinjaman yang curang.

Perusahaan pinjaman yang nyata dan sah tidak akan menuntut pembayaran konstan dan mereka tidak akan menunda pemrosesan transfer pinjaman, jadi harap bijak.

Beberapa bulan yang lalu saya tegang dan putus asa secara finansial, saya ditipu oleh beberapa pemberi pinjaman online, saya hampir kehilangan harapan sampai Tuhan menggunakan teman saya yang merujuk saya kepada pemberi pinjaman yang sangat andal bernama Ms. Cynthia, yang meminjamkan saya pinjaman tanpa jaminan sebesar $ 300.000 dalam kurang dari 24 jam tanpa pembayaran atau tekanan konstan dan tingkat bunga hanya 2%.

Saya sangat terkejut ketika saya memeriksa saldo rekening bank saya dan menemukan bahwa jumlah yang saya terapkan dikirim langsung ke rekening bank saya tanpa penundaan.

Karena saya berjanji akan membagikan kabar baik jika dia membantu saya dengan pinjaman, sehingga orang bisa mendapatkan pinjaman dengan mudah tanpa stres atau penipuan

Jadi, jika Anda membutuhkan pinjaman, silakan hubungi dia melalui email nyata: cynthiajohnsonloancompany@gmail.com dan dengan rahmat Tuhan, dia tidak akan mengecewakan Anda dalam mendapatkan pinjaman jika Anda mematuhi perintahnya.

Anda juga dapat menghubungi saya di email saya: ladymia383@gmail.com dan Setymin yang memperkenalkan dan memberi tahu saya tentang Ms. Cynthia, ini emailnya: arissetymin@gmail.com

Apa yang akan saya lakukan adalah mencoba untuk memenuhi pembayaran pembayaran pinjaman saya yang akan saya kirim langsung ke akun perusahaan setiap bulan.

Sepatah kata cukup untuk orang bijak.

Well written even layman can understand. Thank you.

ReplyDeleteDo you have a bad credit? Do you need money to pay bills? Is it necessary to start a new business? Do you have an unfinished project due to poor funding? Do you need money to invest in any specialty that will benefit you? And you do not know what to do. We offer the following loans;both Personal loans [secure and unsecured], Business loans [secure and unsecured] ,combination loans ,Student loans,Consolidation loans and so many others.

ReplyDeleteCompany name:Mike Morris Finance Group

Company Email:Mikemorrisfinancegroup@gmail.com

Hello, everyone

ReplyDeleteMy name is Josephine jumawan caballo, i live in orion bataan, phillipine. I would like to thank good mother karina roland for helping me got a good loan after I experienced fake online borrowing loans that tricked me to get money without giving a loan, I have needed a loan for 2 years ago to start my own business in the city of orion bataan where I lived and I fell into the hands of a fake company in dubai that deceived me and did not offer me a loan. and I was very Frustrasted because I lost all my money to a fake company in dubai, because I owed my bank and my friends and I had nothing to run, on that very faithful day my friend called susan Ramirez after reading her testimony about how he got a loan from Mrs. karina roland, so I was forced to contact Susan Ramirez and she told me and convinced me to contact Mrs. KARINA ROLAND LOAN COMPANY that she was a good mother and I was forced to put courage and I contacted Mrs. karina roland and I were surprised by my loan that was processed and passed and within 6 hours my loan was transferred to my account and I was very surprised that this was a miracle and I had to give information about the good work of Mrs. KARINA ROLAND so I advise everyone who needs a loan to contact e-mail Mrs. KARINA ROLAND at (karinarolandloancompany@gmail.com) or whatsapp only +1(312)8721-592 and I guarantee you that you will give information as I have done and you can also contact me for further information about Mrs.KARINA ROLAND my email: (josephinejumawancaballo@gmail.com) may God continue to bless and love karina roland' mother to change my financial life.

Selamat siang pak / nyonya

ReplyDeleteKami menyambut Anda ke PERUSAHAAN PINJAMAN ELIZEBETH ISAAC, di mana kami memberikan pinjaman asli dan serius seperti:

LAYANAN PINJAMAN TERSEDIA TERMASUK:

================================

* Pinjaman Komersial.

* Pinjaman pribadi.

* Pinjaman Bisnis.

* Pinjaman Investasi.

* Pinjaman Pembangunan.

* Pinjaman Akuisisi.

* Pinjaman konstruksi.

* Pinjaman Kartu Kredit

* Pinjaman Konsolidasi Utang

* Pinjaman bisnis dan lainnya:

Kami memberikan pinjaman bunga 2% tanpa agunan, sehingga kami dapat mengatakan bahwa kami memberikan PINJAMAN TANPA Agunan, Anda tidak perlu merasa buruk atau kecewa dengan bank yang meminta agunan, cukup hubungi kami dengan mengirim email kepada kami di:

elizebethisaac@gmail.com

Terima kasih

kami menunggu untuk mendengar dari Anda segera

ReplyDeleteAddress: 317 Jln Mengabang Telipot Kampung Tanjong Gelam

21030 Batu Rakit 21030 Malaysia Kuala Terengganu Ter

WhatsApp Number: [+60]1123759663

email:hafizulbin365@gmail.com

Teleph..No:[+60]1123759663

Name:HAFIZUL BIN HAZIQ

Country: Malaysia

Kemarau kewangan saya berakhir pada bulan ini apabila saya fikir semuanya adalah urusan perniagaan dengan beberapa rakan saya di Kuala Lumpur beberapa bulan yang lalu perniagaan yang bernilai beberapa Rm 785.000.00 yang keuntungannya sudah cukup untuk kita semua untuk berkongsi keuntungan tetapi akibat kegagalan perniagaan, kita semua mendapati bahawa kita mempunyai masalah kewangan yang sangat besar kerana saya tidak mempunyai wang untuk bergantung pada ketika perniagaan gagal kerana saya melabur semua saya dengan saya pada perniagaan jadi saya berada di sangat sangat maaf jadi saya terpaksa mencari bantuan kewangan saya sebenarnya telah ditolak oleh beberapa bank sebagai hasil dari kadar pinjaman mereka dan juga syarat mereka jadi saya terpaksa melalui beberapa blog sehingga saya datang menghadapi dengan Iklan Syarikat Ibu. saya menghubungi Ibu dengan segera selepas melalui beberapa proses yang sangat fleksibel permintaan pinjaman saya sebanyak Rm 440.000.00 telah diluluskan oleh pihak pengurusan dan pada keesokannya Lembaga Pengurusan Peminjaman Pinjaman dikreditkan saya tanpa menangguhkan berkat ini dari ibu yang dapat menyelamatkan anda hari ini dari apa-apa embarrazement kewangan anda menjadi ibu hubungi Ibu sekarang untuk pinjaman anda yang berubah e_mail .. [iskandalestari.kreditpersatuan@gmail.com]

Country: Malaysia

Name:HAFIZUL BIN HAZIQ

Teleph... No:[+60]1123759663

email:hafizulbin365@gmail.com

WhatsApp Number:[+60]1123759663

Address:317 Jln Mengabang Telipot Kampung Tanjong

Gelam 21030 Batu Rakit 21030 Malaysia Kuala Terengganu Ter

kesaksian nyata dan kabar baik !!!

ReplyDeleteNama saya mohammad, saya baru saja menerima pinjaman saya dan telah dipindahkan ke rekening bank saya, beberapa hari yang lalu saya melamar ke Perusahaan Pinjaman Dangote melalui Lady Jane (Ladyjanealice@gmail.com), saya bertanya kepada Lady jane tentang persyaratan Dangote Loan Perusahaan dan wanita jane mengatakan kepada saya bahwa jika saya memiliki semua persyarataan bahwa pinjaman saya akan ditransfer kepada saya tanpa penundaan

Dan percayalah sekarang karena pinjaman rp11milyar saya dengan tingkat bunga 2% untuk bisnis Tambang Batubara saya baru saja disetujui dan dipindahkan ke akun saya, ini adalah mimpi yang akan datang, saya berjanji kepada Lady jane bahwa saya akan mengatakan kepada dunia apakah ini benar? dan saya akan memberitahu dunia sekarang karena ini benar

Anda tidak perlu membayar biayaa pendaftaran, biaya lisensi, mematuhi Perusahaan Pinjaman Dangote dan Anda akan mendapatkan pinjaman Anda

untuk lebih jelasnya hubungi saya via email: mahammadismali234@gmail.com

dan hubungi Dangote Loan Company untuk pinjaman Anda sekarang melalui email Dangotegrouploandepartment@gmail.com

Dearest Esteems,

ReplyDeleteWe are Offering best Global Financial Service rendered to the general public with maximum satisfaction,maximum risk free. Do not miss this opportunity. Join the most trusted financial institution and secure a legitimate financial empowerment to add meaning to your life/business.

Contact Dr. James Eric Firm via

Email: fastloanoffer34@gmail.com

Best Regards,

Dr. James Eric.

Executive Investment

Consultant./Mediator/Facilitator

Dearest Esteems,

ReplyDeleteWe are Offering best Global Financial Service rendered to the general public with maximum satisfaction,maximum risk free. Do not miss this opportunity. Join the most trusted financial institution and secure a legitimate financial empowerment to add meaning to your life/business.

Contact Dr. James Eric Firm via

Email: fastloanoffer34@gmail.com

Best Regards,

Dr. James Eric.

Executive Investment

Consultant./Mediator/Facilitator

Nama saya Aditya Aulia saya mengalami trauma keuangan karena saya ditipu dan ditipu oleh banyak perusahaan pinjaman online dan saya pikir tidak ada yang baik bisa keluar dari transaksi online tapi semua keraguan saya segera dibawa untuk beristirahat saat teman saya mengenalkan saya. untuk Ibu pada awalnya saya pikir itu masih akan menjadi permainan bore yang sama saya harus memaksa diri untuk mengikuti semua proses karena mereka sampai pada kejutan terbesar saya setelah memenuhi semua persyaratan karena permintaan oleh proses saya bisa mendapatkan pinjaman sebesar 350jt di rekening Bank Central Asia (BCA) saya saat saya waspada di telepon saya, saya tidak pernah mempercayainya, agaknya saya bergegas ke Bank untuk memastikan bahwa memang benar ibu kontak sekarang mengalami terobosan pemanasan jantung dalam kehidupan finansial Anda melalui apakah itu WhatsApp:::+44] 7480 729811[Chats Only] atau apakah kamu ingin mengkonfirmasi dari saya? Anda bisa menghubungi saya melalui surat saya: {aditya.aulia139@gmail.com} dan juga Anda bisa menghubungi perusahaan ISKANDAR LESTARI LOAN COMPANY (ISKANDAR LENDERS) via: {mail:iskandalestari.kreditpersatuan@gmail.com}

ReplyDeletee_mail:::[aditya.aulia139@gmail.com]

[iskandalestari.kreditpersatuan@gmail.com]

WhatsApp:::+44] 7480 729811[Chats Only]

Telephone Number☎+44] 7480 729811[Calls Only]

BBM INVITE:::[D8980E0B]

Kabar baik

ReplyDeleteNama saya LILOW YETTY, warga negara Indonesia, dari jakarta selatan. Saya ingin menggunakan media ini untuk memberikan saran penting kepada semua warga negara Indonesia yang mencari pinjaman dengan sangat hati-hati karena internet penuh dengan penipu, Beberapa pemberi pinjaman di sini untuk menipu orang dan merobek uang hasil jerih payah mereka, tetapi Ibu Yuliana adalah berbeda

Beberapa bulan yang lalu, saya benar-benar membutuhkan pinjaman tetapi bank tidak dapat menawarkan saya, karena mereka membutuhkan jaminan nyata, yang tidak dapat saya berikan. Saya memutuskan untuk mengajukan pinjaman online dan saya menipu sekitar 19 juta, mencoba membayar biaya tak berujung yang saya tidak pernah tahu adalah semua kebohongan dan bagaimana mereka menipu orang tak berdosa yang membutuhkan bantuan. Saya hampir mati, sampai seorang teman merujuk saya ke pemberi pinjaman yang sangat andal bernama Mother yuliana, pemilik ANTHONY YULIANA LENDERS, Dia adalah pemberi pinjaman global; yang saya hubungi dan mereka meminjamkan saya jumlah pinjaman Rp 700.000.000 dalam waktu kurang dari 48 jam pemrosesan dengan tingkat bunga 1% dan mengubah kehidupan seluruh keluarga saya.

Saya menerima pinjaman saya di rekening bank saya setelah saya membayar asuransi pinjaman dan biaya transfer, ketika saya memeriksa saldo rekening bank saya saya mengetahui bahwa jumlah yang saya ajukan telah dikreditkan ke rekening bank saya

Saya memutuskan untuk mengingatkan dan membagikan kesaksian saya tentang Bunda Yuliana agar orang-orang dari Melayu dan Indonesia dapat memperoleh pinjaman mudah tanpa stres. Jadi, jika Anda membutuhkan pinjaman, silakan hubungi Bunda Yuliana melalui email: (anthony.yulianalenders@gmail.com)

nomor whatsapp +13234026088

BBM INVITE (E37F9BCC)

Anda juga dapat menghubungi saya di email saya: (lilowyetty21@gmail.com) dan Ibu Hendra yang memperkenalkan saya dan memberi tahu saya tentang Bunda yuliana, Dia juga menerima pinjaman dari Bunda yuliana. Anda juga dapat menghubungi dia melalui email: (hendramay77 @ gmail.com) Sekarang saya adalah pemilik bangga seorang wanita bisnis besar di kota saya, Semoga Allah terus memberkati Bunda Yuliana untuk pekerjaan yang baik dalam hidup saya dan keluarga saya.

e_mail:[iskandalestari.kreditpersatuan@gmail.com]

ReplyDeleteWhatsApp Number::::::::::[+60]1123759663

Telephone..Number:[+60]1123759663

email:::::::hafizulbin365@gmail.com

Name::::Hafizul Bin Haziq

Country:::Malaysia

[[[[di atas adalah data peribadi saya]]]]]

Kemarau kewangan saya berakhir pada bulan ini apabila saya fikir semuanya adalah urusan perniagaan dengan beberapa rakan saya di Kuala Lumpur beberapa bulan yang lalu perniagaan yang bernilai beberapa Rm785.000.00 yang keuntungannya sudah cukup untuk kita semua untuk berkongsi keuntungan tetapi akibat kegagalan perniagaan, kita semua mendapati bahawa kita mempunyai masalah kewangan yang sangat besar kerana saya tidak mempunyai wang untuk bergantung pada ketika perniagaan gagal kerana saya melabur semua saya dengan saya pada perniagaan jadi saya berada di sangat sangat maaf jadi saya terpaksa mencari bantuan kewangan saya sebenarnya telah ditolak oleh beberapa bank sebagai hasil dari kadar pinjaman mereka dan juga syarat mereka jadi saya terpaksa melalui beberapa blog sehingga saya datang menghadapi dengan Iklan Syarikat Ibu. saya menghubungi Ibu dengan segera selepas melalui beberapa proses yang sangat fleksibel permintaan pinjaman saya sebanyak Rm440.000.00 telah diluluskan oleh pihak pengurusan dan pada keesokannya Lembaga Pengurusan Peminjaman Pinjaman dikreditkan saya tanpa menangguhkan berkat ini dari ibu yang dapat menyelamatkan anda hari ini dari apa-apa embarrazement kewangan anda menjadi ibu hubungi Ibu sekarang untuk pinjaman anda yang berubah e_mail:[iskandalestari.kreditpersatuan@gmail.com]

ISKANDAR LESTARI LOAN COMPANY "ISKANDAR LENDERS"

[[[[Berikut adalah data peribadi saya]]]]

Country::::::Malaysia

Name::::::::Hafizul Bin Haziq

email::hafizulbin365@gmail.com

Telephone Number:[+60]1123759663

WhatsApp Number::::::::[+60]1123759663

e_mail:[iskandalestari.kreditpersatuan@gmail.com]

Do you need a genuine lender then contact Mrs Kayla, I got my loan from him he is tested and trusted lender contact via email on ( financierlibertycapitals@gmail.com )

ReplyDeleteNama saya Aditya Aulia saya mengalami trauma keuangan karena saya ditipu dan ditipu oleh banyak perusahaan pinjaman online dan saya pikir tidak ada yang baik bisa keluar dari transaksi online tapi semua keraguan saya segera dibawa untuk beristirahat saat teman saya mengenalkan saya. untuk Ibu pada awalnya saya pikir itu masih akan menjadi permainan bore yang sama saya harus memaksa diri untuk mengikuti semua proses karena mereka sampai pada kejutan terbesar saya setelah memenuhi semua persyaratan karena permintaan oleh proses saya bisa mendapatkan pinjaman sebesar 350jt di rekening Bank Central Asia (BCA) saya saat saya waspada di telepon saya, saya tidak pernah mempercayainya, agaknya saya bergegas ke Bank untuk memastikan bahwa memang benar ibu kontak sekarang mengalami terobosan pemanasan jantung dalam kehidupan finansial Anda melalui apakah itu BBM INVITE-nya: {D8980E0B} atau apakah kamu ingin mengkonfirmasi dari saya? Anda bisa menghubungi saya melalui surat saya: {aditya.aulia139@gmail.com} dan juga Anda bisa menghubungi perusahaan ISKANDAR LESTARI LOAN COMPANY (ISKANDAR LENDERS) via: {mail:iskandalestari.kreditpersatuan@gmail.com}

ReplyDeletee_mail:::[aditya.aulia139@gmail.com]

[iskandalestari.kreditpersatuan@gmail.com]

WhatsApp:::[+44] 7480 729811[Chats Only]

Telephone Number☎[+44] 7480 729811[Calls Only]

BBM INVITE:::[D8980E0B]

Halo, saya Nyonya Christy Morris, pemberi pinjaman pribadi memberikan kesempatan pinjaman seumur hidup. Apakah Anda memerlukan pinjaman untuk melunasi utang Anda dengan segera atau Anda membutuhkan pinjaman untuk meningkatkan komersial Anda? Apakah Anda telah ditolak oleh bank dan lembaga keuangan lainnya? Kami memberikan pinjaman kepada individu yang membutuhkan bantuan finansial, yang memiliki utang macet atau butuh uang untuk membayar tagihan, kami memberikan pinjaman dengan bunga rendah 2%. Saya ingin menggunakan media ini untuk memberi tahu Anda bahwa kami memberikan bantuan yang dapat dipercaya dan diuntungkan dan akan bersedia menawarkan Anda pinjaman. Jadi hubungi kami hari ini melalui e-mail di: (christymorrisloanfirm@gmail.com)

ReplyDeleteNama saya Aditya Aulia saya mengalami trauma keuangan karena saya ditipu dan ditipu oleh banyak perusahaan pinjaman online dan saya pikir tidak ada yang baik bisa keluar dari transaksi online tapi semua keraguan saya segera dibawa untuk beristirahat saat teman saya mengenalkan saya. untuk Ibu pada awalnya saya pikir itu masih akan menjadi permainan bore yang sama saya harus memaksa diri untuk mengikuti semua proses karena mereka sampai pada kejutan terbesar saya setelah memenuhi semua persyaratan karena permintaan oleh proses saya bisa mendapatkan pinjaman sebesar 350jt di rekening Bank Central Asia (BCA) saya saat saya waspada di telepon saya, saya tidak pernah mempercayainya, agaknya saya bergegas ke Bank untuk memastikan bahwa memang benar ibu kontak sekarang mengalami terobosan pemanasan jantung dalam kehidupan finansial Anda melalui apakah itu BBM INVITE-nya: {D8980E0B} atau apakah kamu ingin mengkonfirmasi dari saya? Anda bisa menghubungi saya melalui surat saya: {aditya.aulia139@gmail.com} dan juga Anda bisa menghubungi perusahaan ISKANDAR LESTARI LOAN COMPANY (ISKANDAR LENDERS) via: {mail:iskandalestari.kreditpersatuan@gmail.com}

ReplyDeletee_mail:::[aditya.aulia139@gmail.com]

[iskandalestari.kreditpersatuan@gmail.com]

WhatsApp:::[+44] 7480 729811[Chats Only]

Telephone Number☎[+44] 7480 729811[Calls Only]

BBM INVITE:::[D8980E0B]

investing in oil and gas has and is still making a lot of people " very RICH". Investors in oil and gas are getting rich daily. All you need is a secured and certified strategy that will keep your invested capital safe by opting out with no withdrawer crunch. A considerable number of investors worldwide have seen gains of 75,063%, personally I have made over 600%. For example I started investing with $1,000 and I made $3,000, $3,500- $5,000 weekly. Last year at the start of the year, I increased my invested capital to $10,000 and I made approximately $105,000 before the end of year. I've never seen profit opportunities like this before in any market even when other traders complain of losses. Now for the doubters, not only is it possible, it's actually happening right now. All you need is a good and secured strategy, a good investment platform, Appetite and market conditions. Incase you are interested in venturing into investing or perhaps you are trading and has been losing, feel free to contact total company at E-mail: total.company@aol.com or Instagram IG: @total_company , I will

ReplyDeletebe sure to guide and assist you.

Anda dipersilakan untuk "AULIA CONSULT" kami adalah perusahaan pinjaman baru yang didukung oleh BANK DUNIA yang didirikan untuk membantu masyarakat Indonesia dalam kebutuhan bantuan di dunia, melalui bantuan keuangan. karena tingginya aktivitas penipuan yang terjadi di Indonesia, Jadi Jika Anda memerlukan dana untuk memulai bisnis Anda sendiri, atau Anda meminta hipotek untuk meminta pinjaman Anda atau membayar tagihan Anda, mulailah perdagangan yang baik, atau Anda dapat menemukan uang untuk mendapatkan modal hipotek dari bank lokal, kami adalah perusahaan yang menyediakan pinjaman tidak berguna untuk individu yang tertarik dan serius, perusahaan, badan hukum dan orang awam dengan tingkat keuntungan 2%.

ReplyDeleteKami memiliki akses ke koleksi pembayaran untuk perusahaan dan mereka yang memiliki rencana untuk memulai bisnis. Kami percaya bahwa kebajikan dan kenyamanan Anda adalah prioritas optimal kami, kami dapat berada di sini untuk membantu Anda mendapatkan pinjaman dan kami datang untuk membantu Orang Baik INDONESIA di negara saya. dan pastikan Anda orang Indonesia sebelum Anda menghubungi kami, INDONESIA SAJA !!!

CATATAN (NB); JANGAN MENGHUBUNGI KAMI JIKA ANDA TIDAK SERIUS !!!

Surel; (auliafadhlan6@gmail.com)

Layanan kami meliputi:

Membayar Utang

Pinjaman Komersial

Pinjaman Pribadi

Pinjaman Internasional

Pinjaman untuk Pertanian

Modal Ventura

Dan lagi

PINJAMAN KARYAWAN (NB);

Setelah merekomendasikan aplikasi pinjaman, Anda dapat mengharapkan respons awal dalam waktu kurang dari 1 jam dan membiayai dalam waktu 24-96 jam setelah menerima pemberitahuan yang kami butuhkan.

Surel; auliafadhlan6@gmail.com

WhatsApp: (+12342018860)

Tawaran pinjaman berlaku sekarang dengan mendesak.

ReplyDeletePerusahaan saya tertarik pada pendanaan bisnis dan memberikan pinjaman kepada individu, badan hukum, dan perusahaan dengan tingkat bunga rendah. Jika Anda tertarik, silakan kembali ke saya untuk lebih jelasnya Email: bertsloanservices@gmail.com

saudara-saudara

ReplyDeleteSaya di sini untuk bersaksi tentang kebaikan Allah dalam hidup saya dan bagaimana saya diselamatkan dari tekanan finansial karena bisnis saya sedang menurun dan keluarga saya dalam keadaan asulit sehingga kami bahkan tidak dapat membayar uang sekolah untuk anak-anak, karena kepahitan mengambil alih hatiku

Suami saya juga menggagalkan karena kami menjalankan bisnis keluarga di (Surabaya, Jawa Timur) dimana kami jadi bingung suami saya mencoba untuk mendapatkana pinjaman dari bank dia menolak pinjaman jadi dia online mencari pinjaman karenaa dia ditipu oleh sone imposters online yang menjanjikan kepadanya pinjaman dan mengatakan harus membayar biaya untuk mendapatkan pinjaman sehingga husbank saya meminjam uang dari teman-temannya untuk membayar biaya maka mereka meminta biaya lagi dengan beberapa alasan dia harus pergi dan meminjam dari saudaranya di (Bekasi) untuk memastikan dia mendapatkan pinjaman setidaknya untuk membi/aayai kebutuhan keluarga dan setelah dia membuat biaya, dia diminta untuk membayar lagi dengan alasan tertentu, hal ini membuat keluarga kelaparan meningkat sehingga kami harus mengumpulkan makanan dari tetangga dekat kami. dan selama berbulan-bulan kami menderita dan bisnis ditutup untuk sementara waktu

Jadi satu sore yang setia sekitar pukul 14:00 tetangga dekat ini menelepon saya dan mengatakan bahwa dia akan mendapatkan pinjaman dari perusahaan pinjaman secara online sehingga jika dia mendapatkan pinjaman, dia akan mengenalkan saya ke perusahaan tersebut sehingga kami pergi ke ATM bersama-sama dan Memeriksa pinjaman itu tidak ada sehingga kami menunggu sekitar 30 menit kemudian kami mendapat peringatan di teleponnya dari banknya bahwa dia telah menerima monney di akunnya sehingga kami memeriksa saldo rekeningnya dan lihatlah 300 juta kepadanya sebagai pinjaman

Segera saya berteriak di depan umum sambil menangis dan pada saat itu yang bisa saya pikirkan adalah jika saya dengan jumlah seperti itu, masalah saya berakhir, jadi kami pulang ke rumah saya tidak memberi tahu suami saya, dari 1 juta dia memberi saya saya membeli beberapa bahan makanan di rumah dan berlangganan dan tetangga saya dan saya meminta pinjaman kepada perusahaan karena dia memberi saya pedoman sehingga kami mengikuti prosesnya karena prosesnya sama sehingga setelah semua prosesnya, rekan-rekan saya diberi pinjaman oleh saya

.(`’•.¸(` ‘•. ¸* ¸.•’´)¸.•’´)..«´ ONE BILLION RISING FUND¨`»(onebillionrisingfund@gmail.com)

..(¸. •’´(¸.•’´ * `’•.¸)`’•.¸ )..BBM: D8E814FC

Anda juga bisa mendaftar sekarang dan menyelesaikan masalah keuangan Anda

Saya berbagi cerita ini karena saya tahu bahwa begitu banyak orang di luar sana memerlukan bantuan keuangan dan perusahaan akan membantu Anda

Gmail saya adalah

Ratu Efendi Lisa

efendiqueenlisa@gmail.com

Nama saya Aditya Aulia saya mengalami trauma keuangan karena saya ditipu dan ditipu oleh banyak perusahaan pinjaman online dan saya pikir tidak ada yang baik bisa keluar dari transaksi online tapi semua keraguan saya segera dibawa untuk beristirahat saat teman saya mengenalkan saya. untuk Ibu pada awalnya saya pikir itu masih akan menjadi permainan bore yang sama saya harus memaksa diri untuk mengikuti semua proses karena mereka sampai pada kejutan terbesar saya setelah memenuhi semua persyaratan karena permintaan oleh proses saya bisa mendapatkan pinjaman sebesar 350jt di rekening Bank Central Asia (BCA) saya saat saya waspada di telepon saya, saya tidak pernah mempercayainya, agaknya saya bergegas ke Bank untuk memastikan bahwa memang benar ibu kontak sekarang mengalami terobosan pemanasan jantung dalam kehidupan finansial Anda melalui apakah itu BBM INVITE-nya: {D8980E0B} atau apakah kamu ingin mengkonfirmasi dari saya? Anda bisa menghubungi saya melalui surat saya: {aditya.aulia139@gmail.com} dan juga Anda bisa menghubungi perusahaan ISKANDAR LESTARI LOAN COMPANY (ISKANDAR LENDERS) via: {mail:iskandalestari.kreditpersatuan@gmail.com}

ReplyDeletee_mail:::[aditya.aulia139@gmail.com]

[iskandalestari.kreditpersatuan@gmail.com]

WhatsApp:::[+44] 7480 729811[Chats Only]

Telephone Number☎[+44] 7480 729811[Calls Only]

BBM INVITE:::[D8980E0B]

Halo,

ReplyDeleteSaya Ny. Olivia Daniel, pemberi pinjaman pinjaman pribadi yang memberikan pinjaman kesempatan seumur hidup. Apakah Anda membutuhkan pinjaman segera untuk melunasi hutang Anda atau Anda perlu pinjaman untuk meningkatkan bisnis Anda? Anda telah ditolak oleh bank dan lembaga keuangan lainnya? Apakah Anda memerlukan pinjaman konsolidasi atau hipotek? mencari lebih banyak karena kami di sini untuk membuat semua masalah keuangan Anda menjadi masa lalu. Kami meminjamkan dana kepada individu yang membutuhkan bantuan keuangan, yang memiliki kredit buruk atau membutuhkan uang untuk membayar tagihan, untuk berinvestasi pada bisnis pada tingkat 2%. Saya ingin menggunakan media ini untuk memberi tahu Anda bahwa kami memberikan bantuan yang dapat diandalkan dan penerima dan akan bersedia menawarkan pinjaman. Jadi hubungi kami hari ini melalui email di:

(oliviadaniel93@gmail.com)

INSTANT LOAN OFFER

ReplyDeleteMy company is offering Personal Business loan We stand apart from other lenders because we believe in customer service just 2% interest rate We Offer all types of Finance loan

I'll advise you can contact us

abdullahibrahimlender@gmail.com

whatspp Number +918929490461

Mr Ibrahim

Hello Ladies and Gentlemen, Adakah anda memerlukan pinjaman perniagaan, pinjaman peribadi atau pinjaman gadai janji yang mendesak? Jika ya, saya akan menasihati anda untuk menghubungi kami di Sunshine Financial Group melalui alamat e-mel ini (sunshinefinancialgroupinc@gmail.com) untuk mendapatkan pinjaman anda.

ReplyDeleteSunshine Financial Group adalah firma perkhidmatan kewangan yang komprehensif yang komited untuk membantu anda meningkatkan kejayaan kewangan jangka panjang anda. Program khas kami direka untuk membantu mengembangkan, melindungi, dan memelihara kekayaan anda dengan menyampaikan perkhidmatan dan kepakaran peribadi.

Sekiranya anda mendapati sukar untuk mendapatkan pinjaman ekuiti dari bank tempatan atau institusi kewangan lain, bimbang lagi, kerana Kami telah membantu sejumlah individu dan organisasi yang menghadapi kesulitan kewangan di seluruh dunia. Apabila anda memohon dengan kami, anda memohon dengan syarikat yang dipercayai yang mengambil berat tentang keperluan pembiayaan anda. Anda akan dijaga melalui keseluruhan proses.

MANFAAT UTAMA;

- Memohon bila-bila masa, di mana sahaja.

- Menerima wang tunai dalam masa kurang dari 24 jam

- Meminjam dari € 2000 hingga € 20 Juta

- Tiada caj tersembunyi.

- Kadar faedah yang rendah sebanyak 3%

- Anda Dapatkan Peluang Untuk Memilih Tarikh Bayaran Balik, sama ada mingguan, bulanan atau tahunan untuk tempoh 1-30 tahun.

- Kami menawarkan pinjaman bercagar dan tidak bercagar

Jika anda memerlukan pinjaman segera dalam tempoh 24 jam, sila tulis kepada e-mel di bawah untuk mendapatkan maklumat lanjut

Kenalan E-mel: (sunshinefinancialgroupinc@gmail.com)

WhatsApp Hubungi: +447903159998

Kami berharap untuk mendengar daripada anda

Halo, saya ingin menggunakan media ini untuk membagikan kesaksian saya tentang Bagaimana ALLAH menggunakan Nyonya Olivia Daniel untuk mengubah hidup saya dari kemiskinan. sekarang saya memiliki kehidupan yang sehat tanpa stres dan kesulitan keuangan.

ReplyDeleteNama saya Suherman saya dari Kota Surabaya di Indonesia setelah berbulan-bulan mencoba mendapatkan pinjaman di internet dan saya telah scammed dari 15 juta rupiah Indonesia. Saya menjadi sangat putus asa dalam mendapatkan pinjaman dari pemberi pinjaman online bahwa itu adalah kredit yang sah. dan tidak akan menambah rasa sakit saya, Jadi saya memutuskan untuk menoleh ke teman saya untuk menasihati saya tentang cara mendapatkan pinjaman online, Kami membicarakannya dan kesimpulan kami menceritakan tentang seorang wanita bernama Ny. Olivia Daniel. Saya mengajukan permohonan pinjaman sejumlah 700 juta rupiah Indonesia dengan suku bunga rendah 2%, saya setuju tanpa tekanan dan persiapan dilakukan untuk mentransfer dana ke pinjaman saya ke rekening bank saya dalam waktu kurang dari 24 jam dan pinjaman itu disetor ke rekening saya. rekening bank tanpa penundaan.

Saya pikir itu adalah lelucon sampai saya menerima satu mart dari bank saya bahwa akun saya telah dikreditkan dengan jumlah 700 juta rupiah Indonesia. Saya sangat senang bahwa akhirnya ALLAH menjawab doa saya dengan menggunakan ibu untuk membantu saya mendapatkan pinjaman yang dapat memberi saya harapan. Terima kasih banyak kepada Ny, Olivia Daniel karena telah membuat hidup yang adil bagi saya,

jadi saya menyarankan siapa pun yang tertarik untuk mendapatkan pinjaman yang saya maksudkan adalah pemberi pinjaman nyata untuk menghubungi ibu (oliviadaniel93@gmail.com)

Anda masih dapat menghubungi saya jika Anda memerlukan informasi lebih lanjut melalui email: (suherman3860@gmail.com)

sekali lagi terima kasih semua telah membaca kesaksian saya, dan semoga ALLAH terus memberkati kita semua dan memberi kita umur panjang dan kemakmuran

DAFTAR SEKARANG: info@aasimahaadilaahmed.loanfirm.site

ReplyDeletelaman web ::: https: //www.aasimahaadilaahmed.loanfirm.site

E-mel: aasimahaadilaahmed.loanfirm@gmail.com

WhatsApp :::+447723553516

bersaksi whatsApp..+6281617538564

Assalamualaikum Warahmatullahi Wabarakatuh

BAGAIMANA CARA MENGENAI KREDIT PINJAMAN JAMINAN

(a) Peminjam palsu tidak perlu meminta cagaran dan tidak ada laman web

(b) Peminjam palsu tidak mempunyai sijil perniagaan

(c) Peminjam palsu tidak peduli dengan gaji bulanan anda yang membuat anda layak mendapat pinjaman

(d) Peminjam palsu tidak menggunakan Gmail, tidak ada dominan

(e) Peminjam palsu tidak mempunyai alamat pejabat fizikal

(f) Peminjam palsu meminta yuran pendaftaran dan bayaran trans

Daftar sekarang

DAFTAR SEKARANG: info@aasimahaadilaahmed.loanfirm.site

laman web ::: https: //www.aasimahaadilaahmed.loanfirm.site

E-mel: aasimahaadilaahmed.loanfirm@gmail.com

WhatsApp :::+447723553516

bersaksi whatsApp..+6281617538564

. Saya mendapat pinjaman sebanyak Rp3,6 miliar dengan kadar faedah pinjaman sebanyak 1% dari PINJAMAN AASIMAHA ADILA AHMED. Semoga Allah memberkati mereka. InsyaAllah, dengan setia

teddylisa baik

Pengerusi Eksekutif / PENGENALAN Pegawai, VENTURES HARTA TANA

Halo,

ReplyDeletenama saya Siti Aminah dari Indonesia, tolong saya sarankan semua orang di sini harus sangat berhati-hati, karena ada begitu banyak pemberi pinjaman pinjaman palsu di internet, tetapi mereka masih yang asli di perusahaan pinjaman palsu. Saya telah ditipu oleh 4 pemberi pinjaman yang berbeda, saya kehilangan banyak uang karena saya sedang mencari pinjaman dari perusahaan mereka. Saya hampir mati dalam proses karena saya ditangkap oleh orang-orang karena hutang.

Saya hampir menyerah sampai saya meminta saran dari seorang teman yang memperkenalkan saya kepada pemberi pinjaman asli dan perusahaan yang sangat dapat diandalkan yaitu Bunda Alicia Radu yang mendapatkan pinjaman saya dari 800 juta rupiah Indonesia dalam waktu kurang dari 24 jam Tanpa tekanan dan tekanan suku bunga rendah 2%. Saya sangat terkejut ketika memeriksa rekening bank saya dan menemukan jumlah pinjaman yang saya minta telah ditransfer ke rekening bank saya tanpa penundaan atau kekecewaan sehingga saya berjanji bahwa saya akan membagikan kabar baik sehingga orang bisa mendapatkan pinjaman dengan mudah tanpa tekanan dari Bunda Alicia Radu

Saya ingin Anda mempercayai Bunda Alicia Radu dengan sepenuh hati karena ia sangat membantu dalam hidup saya dan kehidupan finansial saya. Anda harus menganggap diri Anda sangat beruntung memiliki kesempatan untuk membaca kesaksian ini hari ini. Jadi, jika Anda membutuhkan pinjaman, hubungi ibu Alicia Radu melalui email: (aliciaradu260@gmail.com)

Anda juga dapat menghubungi saya melalui email saya: (sitiaminah6749@gmail.com) jika Anda memerlukan informasi tentang bagaimana saya mendapat pinjaman dari Ibu Alicia Radu, Anda sangat bebas untuk menghubungi saya dan saya akan dengan senang hati menjawab Anda karena Anda juga dapat membantu orang lain setelah Anda menerima pinjaman Anda.

Halo semua

ReplyDeleteNama saya AISHA MEY (aishamey14@gmail.com) dari jakarta selatan indonesia saya ingin mengucapkan terima kasih kepada ALLAH yang telah mengakhiri penderitaan saya melalui Anthony Yuliana Lenders karena memberi saya jumlah pinjaman Rp 250 juta, bagi mereka yang mencari pinjaman harus sangat berhati-hati karena ada banyak pemberi pinjaman pinjaman palsu di mana-mana hanya sedikit yang asli dan Anthony Yuliana Lenders adalah salah satu pemberi pinjaman online terbaik, saya melakukan pembayaran untuk asuransi pinjaman dan biaya transfer sebelum jumlah pinjaman saya Rp 250 juta ditransfer ke akun saya, untuk mereka yang mencari pinjaman online yang sah dan asli harus menghubungi mereka

(anthony.yulianalenders@gmail.com)

whatsapp (+13234026088)

Halo semua

ReplyDeleteNama saya AISHA MEY (aishamey14@gmail.com) dari jakarta selatan indonesia saya ingin mengucapkan terima kasih kepada ALLAH yang telah mengakhiri penderitaan saya melalui Anthony Yuliana Lenders karena memberi saya jumlah pinjaman Rp 250 juta, bagi mereka yang mencari pinjaman harus sangat berhati-hati karena ada banyak pemberi pinjaman pinjaman palsu di mana-mana hanya sedikit yang asli dan Anthony Yuliana Lenders adalah salah satu pemberi pinjaman online terbaik, saya melakukan pembayaran untuk asuransi pinjaman dan biaya transfer sebelum jumlah pinjaman saya Rp 250 juta ditransfer ke akun saya, untuk mereka yang mencari pinjaman online yang sah dan asli harus menghubungi mereka

(anthony.yulianalenders@gmail.com)

whatsapp (+13234026088)

Assalamualaikum Warahmatullahi Wabarakatuh

ReplyDeleteBAGAIMANA CARA MENGENAI KREDIT PINJAMAN JAMINAN

(a) Peminjam palsu tidak perlu meminta cagaran dan tidak ada laman web

(b) Peminjam palsu tidak mempunyai sijil perniagaan

(c) Peminjam palsu tidak peduli dengan gaji bulanan anda yang membuat anda layak mendapat pinjaman

(d) Peminjam palsu tidak menggunakan gmail, tidak ada dominan

(e) Peminjam palsu tidak mempunyai alamat pejabat fizikal

(f) Peminjam palsu meminta yuran pendaftaran dan bayaran trans

Daftar sekarang

DAFTAR SEKARANG: info@aasimahaadilaahmed.loanfirm.site

laman web ::: https: //www.aasimahaadilaahmed.loanfirm.site

E-mel: aasimahaadilaahmed.loanfirm@gmail.com

WhatsApp :::+447723553516

bersaksi whatsApp..+6281617538564

. Saya mendapat pinjaman sebanyak Rp3,6 miliar dengan kadar faedah pinjaman sebanyak 1% dari PINJAMAN AASIMAHA ADILA AHMED. Semoga Allah memberkati mereka. InsyaAllah, dengan setia

teddylisa baik

Pengerusi Eksekutif / PENGENALAN Pegawai, VENTURES HARTA TANA

Saya memiliki skor kredit yang sangat rendah sehingga upaya saya untuk meminjam dari Bank ditolak. Saya bangkrut sampai-sampai saya tidak mampu makan tiga kali sehari dan juga saya benar-benar bangkrut karena nama saya identik dengan kemiskinan. saya berhutang baik dari teman-teman saya dan juga dari rentenir hidup saya di bawah ancaman saya harus melarikan diri dari rumah dan saya membawa anak-anak saya untuk bertemu ibu mertua saya karena sifat ancaman yang saya terima dari orang-orang yang meminjamkan saya uang Jadi saya harus mencari cara cepat dan mendesak untuk membayar kembali uang itu dan juga memulai bisnis baru usaha pertama saya sangat mengerikan karena saya ditipu sebesar Rp5.390.020.00 saya harus pindah juga dua minggu kemudian saya kehilangan Rp350.000,00 kepada pemberi pinjaman yang curang jadi saya turun secara finansial dan emosional karena ini adalah yang paling tidak saya harapkan sehingga seorang teman saya memberi tahu saya untuk menghubungi email ini: :( iskandalestari.kreditpersatuan@gmail.com) bahwa saya harus meminta jumlah berapa pun berharap agar Bunda Iskandar selalu menjadi kembali untuk memberikan bantuan keuangan kepada siapa pun yang membutuhkan sehingga saya meminta untuk jumlah Rp850.000.000,00 dalam waktu 24 jam cerita saya berubah untuk selamanya saya membayar semua hutang saya dan saya juga memiliki cukup uang untuk membiayai sendiri bisnis semua terima kasih kepada teman saya yang memperkenalkan saya kepada ibu khususnya dan juga kepada Ibu Iskandar pada umumnya untuk mengubah rasa malu saya menjadi terkenal

ReplyDeleteAtas perkenan: ISKANDAR LESTARI LOAN COMPANY

Email: (iskandalestari.kreditpersatuan@gmail.com)

Halo semua

ReplyDeleteNama saya AISHA MEY (aishamey14@gmail.com) dari jakarta selatan indonesia saya ingin mengucapkan terima kasih kepada ALLAH yang telah mengakhiri penderitaan saya melalui Anthony Yuliana Lenders karena memberi saya jumlah pinjaman Rp 250 juta, bagi mereka yang mencari pinjaman harus sangat berhati-hati karena ada banyak pemberi pinjaman pinjaman palsu di mana-mana hanya sedikit yang asli dan Anthony Yuliana Lenders adalah salah satu pemberi pinjaman pinjaman online terbaik, saya melakukan pembayaran untuk asuransi pinjaman saya dan biaya transfer sebelum jumlah pinjaman saya sebesar Rp 250 juta ditransfer ke akun saya, untuk mereka yang mencari pinjaman online yang sah dan asli harus menghubungi mereka

(anthony.yulianalenders@gmail.com)

whatsapp (+13234026088)

Nomor Whatsapp saya: +62 838-2119-1900

ReplyDeleteEmail saya: (parwatidudi350@gmail.com)

Mrs Rebecca Walker (rebeccawalker700@gmail.com)

Nama saya Ny. Parwati Dudi, saya seorang wanita bisnis dari Indonesia. Saya kehilangan uang, tetapi Indonesia 20 juta rupiah karena pemberi pinjaman palsu, toko saya sudah tutup dan saya kehilangan harapan dalam hidup pada hari ini yang setia ketika saya pergi melalui internet. melihat kesaksian online tentang seorang teman yang mendapat pinjaman `dari Ny. Rebecca Walker. Saya diberitahu bahwa dia adalah ibu yang jujur, jadi saya mengajukan pinjaman 100 juta rupiah Indonesia dari ibu jadi setelah proses pinjaman, pinjaman saya dipindahkan ke rekening bank saya dan hari ini, saya punya toko saya menjalankan bisnis saya dan hari ini saya telah melunasi hutang saya, semua berkat Ibu Rebecca Walker dia adalah ibu yang baik Jadi saya berjanji untuk bersaksi dan membagikan kabar baik saya setiap hari dan Anda juga dapat menghubungi email ibu (rebeccawalker700@gmail.com)

jika Anda memerlukan informasi tentang bagaimana saya mendapat pinjaman dari Mother Rebecca Walker, Anda sangat bebas untuk menghubungi saya di nomor Whatsapp saya: +62 838-2119-1900

Anda juga dapat menghubungi saya melalui email saya: (parwatidudi350@gmail.com)

semoga Tuhan terus memberkatinya dan melindunginya karena dia adalah orang yang baik

KABAR BAIK !!! KABAR BAIK !!! KABAR BAIK!!!

ReplyDeleteHalo semua, nama saya Mrs. Arya Theresia, saya dari Indonesia, saya ingin menggunakan media ini untuk membagikan kesaksian saya tentang bagaimana saya mendapatkan pinjaman dari MRS CHRISTY MORRIS LOAN FIRM karena begitu banyak pemberi pinjaman kredit palsu di sini di internet dan juga untuk memberi tahu Anda bahwa saya adalah korban penipu internet berkali-kali, jadi saya tidak kehilangan harapan sampai saya dirujuk oleh seorang teman ke pemberi pinjaman terpercaya bernama MRS. CHRISTY MORRIS yang meminjamkan pinjaman tanpa jaminan sebesar Rp850.000,0000 dalam waktu kurang dari 48 jam tanpa tekanan, saya sarankan CHRISTY MORRIS LOAN FIRM adalah yang terbaik dan saya berdoa Tuhan akan memberkati mereka dan menjaga bisnis mereka maju, Amin

Jika Anda memerlukan bantuan tentang cara mendapatkan pinjaman, Anda dapat menghubungi saya melalui email: (aryatheresia750@gmail.com)

Anda dapat menghubungi perusahaan secara langsung dengan pinjaman mereka

Email: (christymorrisloanfirm@gmail.com)

Terima kasih

Arya Theresia

KABAR BAIK!!! KABAR BAIK!!! KABAR BAIK!!!

DeleteNama saya Liliyana. Saya ingin menggunakan media ini untuk mengingatkan semua pencari pinjaman agar sangat berhati-hati, karena ada penipuan di mana-mana, mereka akan mengirim dokumen perjanjian palsu kepada Anda dan mereka akan mengatakan tidak ada pembayaran dimuka, tetapi mereka iseng, karena mereka kemudian akan bertanya pembayaran biaya lisensi atau biaya registrasi dan biaya transfer, jadi berhati-hatilah dengan perusahaan pinjaman palsu mereka.

Beberapa minggu yang lalu saya tegang secara finansial dan berkecil hati, saya tertipu oleh beberapa pemberi pinjaman online. Saya hampir kehilangan harapan sampai Tuhan menggunakan teman saya yang merujuk saya ke pemberi pinjaman yang sangat andal bernama Mrs. Christabel Missan, yang meminjamkan pinjaman tanpa jaminan sebesar USD 100.000 dalam waktu kurang dari 24 jam tanpa tekanan atau tekanan dan tingkat bunga hanya 2%,

Saya sangat terkejut ketika saya memeriksa saldo rekening bank saya dan menemukan bahwa jumlah yang saya kirim dikirim langsung ke rekening bank saya tanpa penundaan.

Karena saya berjanji untuk membagikan kabar baik, sehingga orang bisa mendapatkan pinjaman dengan mudah tanpa stres. Jadi, jika Anda membutuhkan pinjaman dalam bentuk apa pun, silakan hubungi dia melalui email nyata: christabelloancompany@gmail.com dan dengan rahmat Tuhan ia tidak akan mengecewakan Anda dalam mendapatkan pinjaman jika Anda patuh.

Anda juga dapat menghubungi nomor whatsApp ibu +15614916019

Anda juga dapat menghubungi saya di email saya: liliyanabasuki@gmail.com dan Sety diperkenalkan dan berbicara tentang Ms. Christabel, dia juga mendapat pinjaman baru dari Ms. Christabel Missan, Anda juga dapat menghubunginya melalui email: permatabudiwati@gmail.com dan Anda juga dapat menghubungi Dian Pelangi yang memperkenalkan kami ke lianmeylad@gmail.com, yang akan saya lakukan adalah mencoba memenuhi pembayaran pinjaman saya yang saya kirim langsung ke akun mereka setiap bulannya

Sepatah kata cukup untuk orang bijak dari Indonesia dan Malaysia

Email: christabelloancompany@gmail.com

Facebook: christabelmissancompany@gmail.com

Anda juga dapat menghubungi nomor whatsApp ibu +15614916019

Panggilan telepon +15614916019

Assalamualaikum, saya JERRY ANDI sangat gembira kerana saya mendapat pinjaman kedua dari Anthony Yuliana Lenders dan kali ini saya mendapat pinjaman sebanyak Rp 330 juta setelah saya meminta untuk membuat bayaran untuk biaya insurans dan bayaran transfer saya, semua pujian yang dialamatkan kepada ALLAH, saya mendapat pinjaman sebesar Rp 330 juta dari Anthony Yuliana Lender agar ALLAH memberkati mereka semua, nasihat saya kepada mereka yang mencari pinjaman di situs ini sehingga mereka harus berhati-hati karena ada banyak peminjam pinjaman palsu , Anthony Yuliana Lenders adalah salah satu pinjaman peminjam terbaik dalam talian untuk pinjaman 100%, hubungi

ReplyDelete(anthony.yulianalender@gmail.com)

atau whatsapp +1 (323) 4026088

email me{jerryandi843@gmail.com}

Halo,

ReplyDeleteNama saya ROBBI dari Cirebon Jawa Barat Indonesia, saya ingin mengucapkan terima kasih kepada ibu Alicia Radu karena membantu saya mendapatkan pinjaman yang baik setelah saya banyak menderita di tangan para pemberi pinjaman online palsu yang menipu saya untuk mendapatkan uang tanpa menawarkan saya pinjaman, saya Saya memerlukan pinjaman selama 3 tahun terakhir untuk memulai bisnis saya sendiri di kota Cirebon tempat saya tinggal dan saya jatuh ke tangan perusahaan palsu di Turki yang telah menipu saya dan tidak menawarkan saya pinjaman. dan saya sangat Frustrasted karena saya kehilangan semua uang saya ke perusahaan palsu di Turki, karena saya berutang kepada bank saya dan teman-teman saya dan saya tidak punya seorangpun untuk menjalankan, sampai suatu hari setia bahwa seorang teman saya bernama Siti Aminah setelah membaca kesaksiannya tentang bagaimana dia mendapat pinjaman dari Bunda Alicia Radu, jadi saya harus menghubungi Siti Aminah dan dia mengatakan kepada saya dan meyakinkan saya untuk menghubungi Bunda Alicia Radu bahwa dia adalah ibu yang baik dan saya harus mengumpulkan keberanian dan saya menghubungi Bunda Alicia Radu dan saya terkejut dengan pinjaman saya diproses dan disetujui dan dalam waktu 3 jam pinjaman saya dipindahkan ke akun saya dan saya sangat terkejut bahwa ini adalah keajaiban dan saya harus bersaksi tentang pekerjaan baik Bunda Alicia Radu

jadi saya akan menyarankan semua orang yang membutuhkan pinjaman untuk menghubungi email Ibu Alicia Radu: (aliciaradu260@gmail.com) dan saya meyakinkan Anda bahwa Anda akan bersaksi seperti yang telah saya lakukan dan Anda juga dapat menghubungi saya untuk informasi lebih lanjut tentang Bunda Alicia Radu email saya : (robbi5868@gmail.com) dan Anda masih dapat menghubungi Siti Aminah yang memperkenalkan saya kepada ibu Alicia Radu melalui email: (sitiaminah6749@gmail.com)

semoga Tuhan terus memberkati dan mencintai ibu Alicia Radu untuk mengubah kehidupan finansial saya

Assalamualaikum, saya JERRY ANDI sangat senang karena saya mendapat pinjaman kedua dari Anthony Yuliana Lenders dan kali ini saya mendapat pinjaman sejumlah Rp 330 juta setelah saya diminta melakukan pembayaran untuk biaya asuransi pinjaman dan biaya transfer, semua pujian ditujukan kepada ALLAH, saya mendapat pinjaman Rp 330 juta dari Anthony Yuliana Pemberi Pinjaman semoga ALLAH memberkati mereka semua, saran saya kepada mereka yang mencari pinjaman di situs ini bahwa mereka harus sangat berhati-hati karena ada banyak pemberi pinjaman pinjaman palsu , Anthony Yuliana Lenders adalah salah satu kreditur pinjaman online terbaik untuk pinjaman 100%, hubungi

ReplyDelete(anthony.yulianalender@gmail.com)

atau whatsapp +1 (323) 4026088

email saya{jerryandi843@gmail.com}

PERUSAHAAN PINJAMAN ALEXANDER GRACE

ReplyDeleteANDA SELAMAT DATANG DI GRACEALEXLOANCOMPANY (GALC)

Good Day Sir / Madam: Apakah Anda memerlukan pinjaman mendesak untuk membiayai bisnis Anda atau tujuan apa pun? Kami adalah pemberi pinjaman bersertifikat, legal dan internasional, kami menawarkan pinjaman kepada perusahaan-perusahaan Bisnis. Perorangan, perusahaan perusahaan, badan hukum dengan tingkat bunga yang terjangkau 2%. Ini bisa berupa pinjaman jangka pendek atau jangka panjang atau bahkan jika Anda memiliki kredit macet. Kami akan memproses pinjaman Anda segera setelah kami menerima aplikasi Anda. Kami adalah lembaga keuangan independen. Kami telah membangun reputasi yang sangat baik selama bertahun-tahun dalam menyediakan berbagai jenis pinjaman kepada ribuan pelanggan kami. Kami menawarkan pinjaman Pendidikan, pinjaman Bisnis, pinjaman rumah, pinjaman pertanian, pinjaman pribadi, pinjaman mobil dengan riwayat kredit baik atau buruk. Jika Anda tertarik dengan penawaran pinjaman kami di atas, Anda disarankan untuk mengisi informasi di bawah ini dan kembali kepada kami untuk lebih jelasnya. Anda dapat menghubungi kami melalui email ini gracealexanderloancompany@gmail.com kami akan merespons Anda segera setelah kami menerima rincian aplikasi pinjaman Anda di bawah ini.

1) Nama lengkap:

2) Tanggal lahir:

3) Jenis Kelamin:

4) Status perkawinan:

5) Jumlah Pinjaman yang Dibutuhkan:

6) Durasi Pinjaman:

7) Negara:

8) Negara:

9) Alamat:

10) Telepon:

11) Penghasilan bulanan:

12) Pekerjaan:

13) Agama:

14) Nama Facebook:

15) Sudahkah Anda mengajukan pinjaman sebelumnya? Jika ya sebutkan nama perusahaan

Kontak

gracealexanderloancompany@gmail.com untuk perhatian segera.

Buka 24 jam dalam 7 hari seminggu.

Halo, saya ingin menggunakan media ini untuk membagikan kesaksian saya tentang Bagaimana ALLAH menggunakan Nyonya Olivia Daniel untuk mengubah hidup saya dari kemiskinan. sekarang saya memiliki kehidupan yang sehat tanpa stres dan kesulitan keuangan.

ReplyDeleteNama saya Suherman. Saya dari Kota Surabaya di Indonesia setelah berbulan-bulan mencoba mendapatkan pinjaman di internet dan saya telah scammed dari 15 juta rupiah Indonesia. Saya menjadi sangat putus asa dalam mendapatkan pinjaman dari pemberi pinjaman online yang merupakan kredit yang sah. dan tidak akan menambah rasa sakit saya, Jadi saya memutuskan untuk menoleh ke teman saya untuk menasihati saya tentang cara mendapatkan pinjaman online, Kami membicarakannya dan kesimpulan kami menceritakan tentang seorang wanita bernama Ny. Olivia Daniel. Saya mengajukan permohonan pinjaman sejumlah 700 juta rupiah Indonesia dengan suku bunga rendah 2%, saya setuju tanpa tekanan dan persiapan dilakukan untuk mentransfer dana ke pinjaman saya ke rekening bank saya dalam waktu kurang dari 24 jam dan pinjaman itu disetor ke rekening saya. rekening bank tanpa penundaan.

Saya pikir itu adalah lelucon sampai saya menerima satu mart dari bank saya bahwa akun saya telah dikreditkan dengan jumlah 700 juta rupiah Indonesia. Saya sangat senang bahwa akhirnya ALLAH menjawab doa saya dengan menggunakan ibu untuk membantu saya mendapatkan pinjaman yang dapat memberi saya harapan. Terima kasih banyak kepada Ny, Olivia Daniel karena telah membuat kehidupan yang adil bagi saya,

jadi saya menyarankan siapa pun yang tertarik untuk mendapatkan pinjaman yang saya maksudkan adalah pemberi pinjaman nyata untuk menghubungi email ibu: (oliviadaniel93@gmail.com)

Anda masih dapat menghubungi saya jika Anda memerlukan informasi lebih lanjut melalui email: (suherman3860@gmail.com)

sekali lagi terima kasih semua telah membaca kesaksian saya, dan semoga ALLAH terus memberkati kita semua dan memberi kita umur panjang dan kemakmuran

Halo semuanya, nama saya Sarah Adia dari Indonesia, saya ingin menggunakan media ini untuk berterima kasih kepada ALLAH yang telah mewujudkan impian saya, saya telah mencari pinjaman selama 2 tahun terakhir sekarang sampai teman saya yang namanya LILOW BELUM memperkenalkan saya kepada Anthony Yuliana Lenders pemberi pinjaman yang andal, di mana saya akhirnya mendapatkan pinjaman sebesar Rp350 juta, saya hanya melakukan pembayaran untuk asuransi pinjaman saya dan biaya transfer sebelum Anthony Yuliana Lenders mentransfer pinjaman sebesar Rp350 juta ke dalam akun saya, saya akan suka untuk menggunakan kesempatan ini untuk menasihati mereka yang mencari pinjaman untuk berhati-hati karena 70% dari pemberi pinjaman palsu hanya sedikit yang nyata. jika Anda tertarik pada pinjaman, saya ingin memberi nasihat bahwa Anda harus menghubungi pemberi pinjaman yang andal melalui email (anthony.yulianalenders@gmail.com)

ReplyDeleteatau melalui BBM INVITE (E37F9BCC)

atau melalui whatsapp +13234026088,

email saya untuk informasi lebih lanjut (sarahadia234@gmail.com)

Halo semuanya, nama saya Sarah Adia dari Indonesia, saya ingin menggunakan media ini untuk berterima kasih kepada ALLAH yang telah mewujudkan impian saya, saya telah mencari pinjaman selama 2 tahun terakhir sekarang sampai teman saya yang namanya LILOW BELUM memperkenalkan saya kepada Anthony Yuliana Lenders pemberi pinjaman yang andal, di mana saya akhirnya mendapatkan pinjaman sebesar Rp350 juta, saya hanya melakukan pembayaran untuk asuransi pinjaman saya dan biaya transfer sebelum Anthony Yuliana Lenders mentransfer pinjaman sebesar Rp350 juta ke dalam akun saya, saya akan suka untuk menggunakan kesempatan ini untuk menasihati mereka yang mencari pinjaman untuk berhati-hati karena 70% dari pemberi pinjaman palsu hanya sedikit yang nyata. jika Anda tertarik pada pinjaman, saya ingin memberi nasihat bahwa Anda harus menghubungi pemberi pinjaman yang andal melalui email (anthony.yulianalenders@gmail.com)

ReplyDeleteatau melalui BBM INVITE (E37F9BCC)

atau melalui whatsapp +13234026088,

email saya untuk informasi lebih lanjut (sarahadia234@gmail.com)

Halo semua

ReplyDeleteNama saya AISHA MEY (aishamey14@gmail.com) dari jakarta selatan indonesia saya ingin mengucapkan terima kasih kepada ALLAH yang telah mengakhiri penderitaan saya melalui Anthony Yuliana Lenders karena memberi saya jumlah pinjaman Rp 250 juta, bagi mereka yang mencari pinjaman harus sangat berhati-hati karena ada banyak pemberi pinjaman pinjaman palsu di mana-mana hanya sedikit yang asli dan Anthony Yuliana Lenders adalah salah satu pemberi pinjaman online terbaik, saya melakukan pembayaran untuk asuransi pinjaman saya dan biaya transfer sebelum jumlah pinjaman saya sebesar Rp 250 juta ditransfer ke akun saya, untuk mereka yang mencari pinjaman online yang sah dan asli harus menghubungi mereka

(anthony.yulianalenders@gmail.com)

whatsapp (+13234026088)

IF YOU’RE LOOKING FOR THE BEST WAY TO RECOVER YOUR FUNDS FROM ONLINE BINARY OPTIONS BROKER, HERE IS THE ANSWER. There are some binary options companies that are licensed and regulated by regulators Examples are The FCA (of the UK), ASIC (of Australia), CySec (of Cyprus) that can and will take action against brokers that don’t follow the rules. But if you are dealing with an unregulated binary options broker, then you need some expert’s assistance. service company that specialize in carrying out intelligence on the activities of online company such as binary options broker, Forex broker and fraudulent online company can assist victims recover their lost funds. There are different Strategy they can employ which include litigation (which can often involve hiring private investigators) and can cost thousands of dollars if not more. For losses of 50,000 or more, this would be an option to consider. They have in-house of private investigators who can bring real pressure on the actual owner (or owners) of the firm itself. Most binary options companies out there are fraudulent. They are all scams. It actually hurts and bring tears to my eyes when I read comments of scammed victims ripped off by BINARY OPTIONS AND FAKE RECOVERY EXPERT on forums. I know actually how it feels and hurts to lose money you have worked half of your life for to invest with the thoughts of getting returns when you are retired and turns out it’s all a scam in the end. This is why you need to get the right person to help you out but with the rate at which a lot of scammers disguising as recovery expert and come online to rip people off, it becomes difficult to get the right person. Mail: Ew5599013@gmail.com I hope this helps anyone who needs this information 100% security guaranteed, can also help spy on records. Best of luck working together.

ReplyDeleteNama saya Elang Endah Saya seorang wanita bisnis di Indonesia dan saya bepergian ke negara lain karena bisnis, saya beberapa waktu yang lalu saya memiliki kemunduran dalam bisnis saya karena seseorang yang saya percayai begitu banyak berbohong kepada saya dan mengambil banyak uang saya. modal dengan harapan mengirimi saya barang. Saya mulai mencari bantuan dan seorang teman memperkenalkan saya ke Arab Credit Group Beberapa bulan yang lalu, saya takut karena cerita yang saya dengar tentang pinjaman online sebelumnya, tetapi saya berkata pada diri sendiri bahwa saya harus mencobanya, setelah menyelesaikan semua persyaratan yang saya miliki. pinjaman sebesar 700jt telah ditransfer kepada saya dan hari ini saya sepenuhnya kembali ke bisnis, jika Anda memiliki tantangan keuangan atau Anda mencari modal untuk memulai bisnis Anda sendiri di sini adalah kesempatan Anda, jika mereka dapat membantu saya tahu mereka akan membantu Anda juga . hubungi Arab Credit Group hari ini dan Anda akan senang melakukannya.

ReplyDeleteDetail saya

nama: Elang Endah

email: elangendah7@gmail.com

hubungi Arab Credit Group menggunakan.

Perusahaan: Arab Credit Group

Email: Arabcreditgroup@gmail.com

Terima kasih kepada Allah ketika saya berpikir bahwa semuanya sudah selesai dengan saya. Ibu Mother Rika Anderson datang untuk menyelamatkan saya. Saya Hasna Fadlika dari jln kebon cau no 125 Jarkata Indonesia. Saya sangat berhutang budi kepada orang-orang yang saya pinjam uang dari geng melawan saya dan kemudian membuat saya ditangkap sebagai akibat dari hutang saya.

ReplyDeleteSaya ditahan selama berbulan-bulan sehingga saya diberi waktu untuk membayar kembali hutang saya ketika saya dipulangkan dan dibebaskan untuk pergi dan mencari uang untuk membayar semua hutang yang saya ambil.

Saya diberitahu bahwa ada beberapa kreditor online yang sah jadi saya harus mencari karena melalui blog saya saya berulang kali tertipu tetapi ketika saya menemukan Mrs. Rika Anderson, CEO RIKA ANDERSON LOAN COMPANY, Tuhan mengarahkan saya untuk mencari melalui blog karena pertemuan saya dengan ibu benar-benar sebuah mukjizat mungkin karena Tuhan telah melihat bahwa saya memiliki banyak penderitaan sehingga ia mengarahkan saya kepada ibu.

Saya mengajukan pinjaman dan setelah beberapa jam pinjaman saya diproses oleh Dewan tanpa jaminan dan dalam waktu empat jam, saya dikreditkan dengan jumlah persis yang saya minta Rp50,000,000. Semua ini tanpa agunan tambahan sama seperti saya berbicara kepada Anda sekarang bahwa saya telah dapat menghapus semua hutang saya dan sekarang saya memiliki supermarket sendiri.

Saya tidak membutuhkan bantuan orang lain sebelum memberi makan atau mengambil keputusan keuangan apa pun. Saya tidak punya urusan dengan polisi lagi. Saya sekarang seorang wanita yang mandiri dan bahagia dengan keluarga saya. Anda ingin mengalami kemandirian finansial seperti saya, silakan hubungi ibu Rika. melalui WhatsApp +19147057484 atau melalui email perusahaan: (rikaandersonloancompany@gmail.com) Anda tidak dapat memperdebatkan kenyataan bahwa di dunia yang penuh kesulitan ini, Anda membutuhkan seseorang untuk membantu Anda menangani gejolak keuangan dalam hidup Anda dengan satu atau lain cara.

Saya memberi Anda mandat untuk mencoba dan menghubungi Ms. Rika Anderson di alamat di atas sehingga Anda dapat mengatasi krisis keuangan dalam hidup Anda. Anda dapat menghubungi saya melalui email berikut: (hasnafadlika17@gmail.com) selalu bersikap positif dengan Ms. Rika Anderson, dia akan melihat Anda melalui semua tantangan keuangan Anda dan kemudian memberi Anda tampilan keuangan baru.

silakan hubungi ibu RIKA ANDERSON LOAN COMPANY. melalui WhatsApp +19147057484 atau melalui email perusahaan: (rikaandersonloancompany@gmail.com)

Terima kasih kepada Allah ketika saya berpikir bahwa semuanya sudah selesai dengan saya. Ibu Mother Rika Anderson datang untuk menyelamatkan saya. Saya Hasna Fadlika dari jln kebon cau no 125 Jarkata Indonesia. Saya sangat berhutang budi kepada orang-orang yang saya pinjam uang dari geng melawan saya dan kemudian membuat saya ditangkap sebagai akibat dari hutang saya.

ReplyDeleteSaya ditahan selama berbulan-bulan sehingga saya diberi waktu untuk membayar kembali hutang saya ketika saya dipulangkan dan dibebaskan untuk pergi dan mencari uang untuk membayar semua hutang yang saya ambil.

Saya diberitahu bahwa ada beberapa kreditor online yang sah jadi saya harus mencari karena melalui blog saya saya berulang kali tertipu tetapi ketika saya menemukan Mrs. Rika Anderson, CEO RIKA ANDERSON LOAN COMPANY, Tuhan mengarahkan saya untuk mencari melalui blog karena pertemuan saya dengan ibu benar-benar sebuah mukjizat mungkin karena Tuhan telah melihat bahwa saya memiliki banyak penderitaan sehingga ia mengarahkan saya kepada ibu.

Saya mengajukan pinjaman dan setelah beberapa jam pinjaman saya diproses oleh Dewan tanpa jaminan dan dalam waktu empat jam, saya dikreditkan dengan jumlah persis yang saya minta Rp50,000,000. Semua ini tanpa agunan tambahan sama seperti saya berbicara kepada Anda sekarang bahwa saya telah dapat menghapus semua hutang saya dan sekarang saya memiliki supermarket sendiri.

Saya tidak membutuhkan bantuan orang lain sebelum memberi makan atau mengambil keputusan keuangan apa pun. Saya tidak punya urusan dengan polisi lagi. Saya sekarang seorang wanita yang mandiri dan bahagia dengan keluarga saya. Anda ingin mengalami kemandirian finansial seperti saya, silakan hubungi ibu Rika. melalui WhatsApp +19147057484 atau melalui email perusahaan: (rikaandersonloancompany@gmail.com) Anda tidak dapat memperdebatkan kenyataan bahwa di dunia yang penuh kesulitan ini, Anda membutuhkan seseorang untuk membantu Anda menangani gejolak keuangan dalam hidup Anda dengan satu atau lain cara.

Saya memberi Anda mandat untuk mencoba dan menghubungi Ms. Rika Anderson di alamat di atas sehingga Anda dapat mengatasi krisis keuangan dalam hidup Anda. Anda dapat menghubungi saya melalui email berikut: (hasnafadlika17@gmail.com) selalu bersikap positif dengan Ms. Rika Anderson, dia akan melihat Anda melalui semua tantangan keuangan Anda dan kemudian memberi Anda tampilan keuangan baru.

silakan hubungi ibu RIKA ANDERSON LOAN COMPANY. melalui WhatsApp +19147057484 atau melalui email perusahaan: (rikaandersonloancompany@gmail.com)

KABAR BAIK!!! KABAR BAIK!!! KABAR BAIK!!!